How To Calculate Tax On Mobile Phones In Pakistan

Mobile phone ownership has become an essential part of daily life in Pakistan. However, with increasing imports and the introduction of regulatory measures, consumers must be aware of the tax obligations when bringing in mobile phones. This blog will guide you on how to calculate the tax on mobile phones in Pakistan and provide insights on various methods, including the use of the PTA calculator on Calculate Now.

What is the PTA (Pakistan Telecommunication Authority) and Why is It Important?

Before we dive into how to calculate tax, let’s understand the role of the PTA in Pakistan’s mobile phone regulation. The PTA is responsible for controlling mobile phone imports and ensuring the lawful usage of mobile phones in the country. If you bring a mobile phone into Pakistan, the PTA ensures it complies with the country’s regulations, including taxes and duties. If you’re importing a phone, it is necessary to register it with the PTA to use it in Pakistan.

Steps to Calculate Tax on Mobile Phones in Pakistan

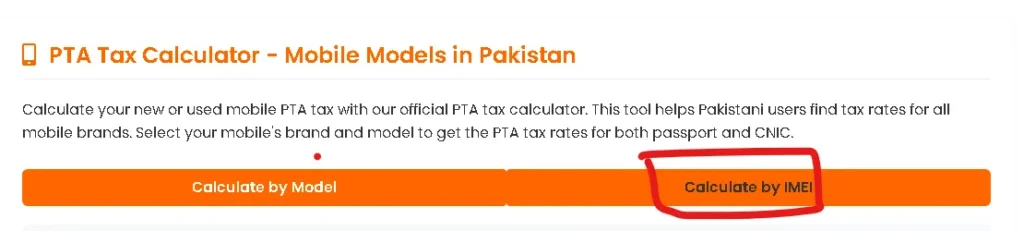

When importing or registering a mobile phone in Pakistan, the tax calculation can be done through the PTA Tax Calculator. Follow these steps to calculate the tax on your mobile phone:

- Visit the PTA Tax Calculator: Go to the official PTA website and access the mobile registration or tax calculation section.

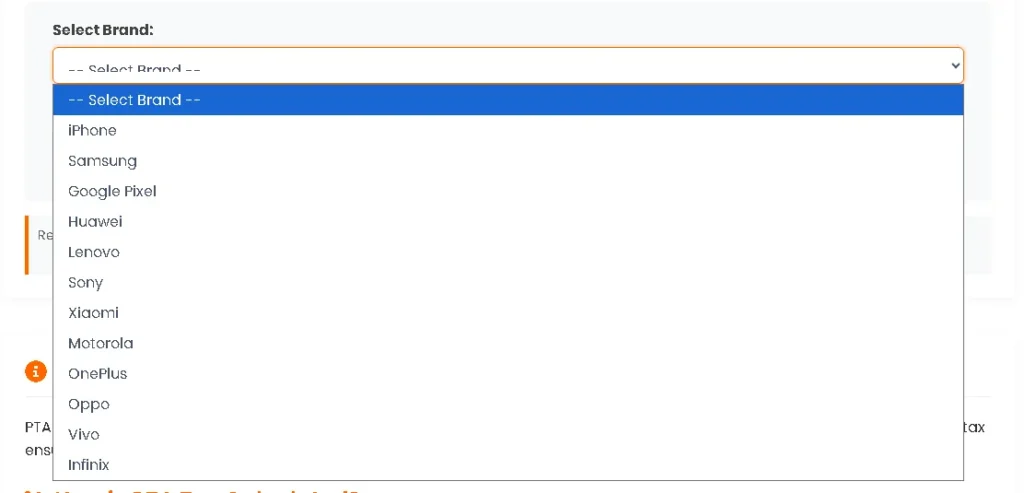

- Select Your Mobile Phone Brand: In the PTA tax calculator, you need to select the Mobile Phone Brand first. The calculator provides a drop-down menu from which you can choose the brand.

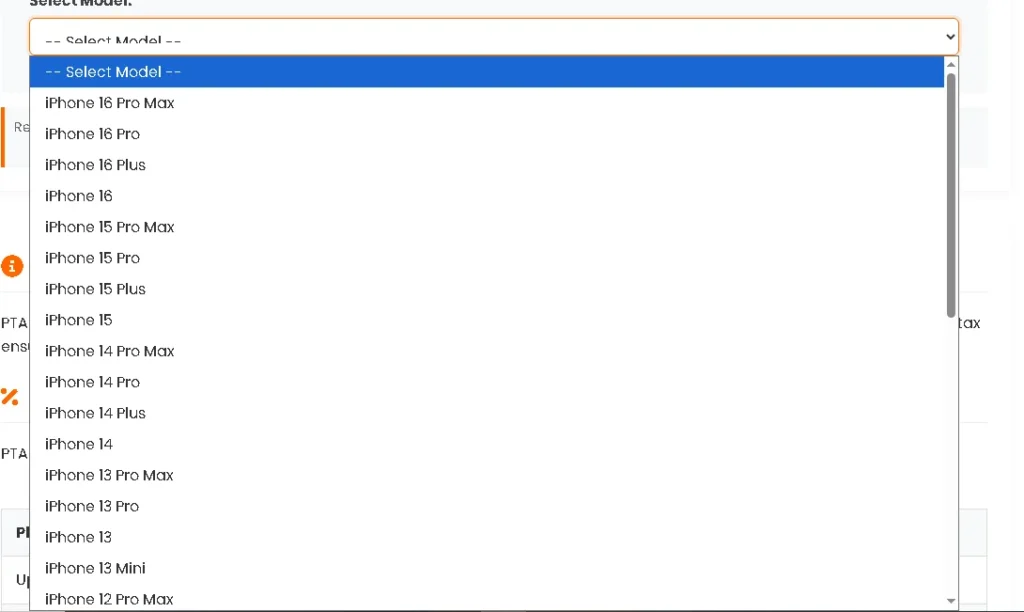

3. Select Your Mobile Model: After selecting the brand, you will be prompted to choose your phone model. Some phones may have different taxes based on their model specifications (such as price range or import status).

4. Enter IMEI Number: The IMEI (International Mobile Equipment Identity) number is a unique identifier for your mobile phone. You can find the IMEI number by typing *#06# on your mobile phone or by checking the box of the phone.

How the PTA Tax Calculator Works

The PTA tax calculator works by comparing the IMEI number you entered with the data on record. Based on the phone’s model and IMEI, the calculator will show:

- The applicable tax or duty that needs to be paid for the phone.

- The registration fee if it is a new phone or if it needs to be imported into Pakistan.

Different Methods of Tax Calculation

In Pakistan, there are multiple ways to calculate and pay the tax on mobile phones. Here are a few common methods:

- Through CNIC (Computerized National Identity Card): One of the easiest ways to calculate tax on mobile phones in Pakistan is by entering your CNIC number into the PTA Tax Calculator. This will display the amount of tax applicable to the mobile phone.

- Through Passport Number: For foreign nationals, you can use your passport number to calculate the tax. This option is helpful for those bringing mobile phones into Pakistan from abroad.

How to Pay Taxes on Mobile Phones

Once you know the tax amount, you can proceed with the payment. Typically, taxes can be paid through various online methods like:

- Bank transactions: Pay through your bank’s online platform.

- Mobile wallet services: Such as EasyPaisa or JazzCash.

Ensure that you have the correct details (IMEI, model, etc.) while making payments.

Important Points to Remember

- Tax Rates: The tax rates vary based on the mobile phone’s price and specifications.

- Registration Fees: New mobile phones or imported phones require registration, which involves paying a registration fee in addition to the taxes.

PTA Registration: Once the tax is calculated and paid, your phone will be registered with the PTA.

Conclusion

Calculating tax on mobile phones in Pakistan is a straightforward process with the help of the PTA Tax Calculator. By following the steps mentioned above, you can easily determine the tax amount and pay it accordingly. Make sure to have all the necessary details ready (such as IMEI number, CNIC, or Passport number) to avoid delays in registration.

Once the tax is paid, your phone will be successfully registered with the PTA, and you can enjoy using your mobile phone without any interruptions. Stay informed, and keep these tips in mind to ensure a smooth registration process.